I. OVERVIEW

This Corporate Governance Statement sets out the Credit Corporation Group’s key governance policies and practices.

Credit Corporation (PNG) Limited (CCP) is incorporated in Papua New Guinea (PNG) and is listed on PNG’s national stock exchange, PNGX Markets (PNGX). The Group’s head office is in PNG where most functional leads are housed to effect governance oversight to its locally incorporated subsidiaries in the other countries in which the Group operates throughout the South Pacific.

Our governance structure is influenced by the requirements of regulators throughout the South Pacific, with the parent company, Credit Corporation, maintaining oversight on holistic issues and global influences, and being responsible for setting and monitoring compliance with the Group’s governance framework.

Credit Corporation and its subsidiaries each have a Board and Management structure appropriate for their operations, complexity, growth and size. Whilst our subsidiaries are locally incorporated in the jurisdiction in which they operate, they must comply with the Group’s Corporate Governance Framework.

Legal and Regulatory Framework

Credit Corporation and each of its subsidiaries must comply with relevant laws in each of the countries in which they operate.

While CCP is not a regulated entity itself, its finance subsidiaries must comply with strict regulatory requirements in respect of governance, capital, liquidity, risk management, conduct, financial crime and systems and controls, among other things.

CCP is publicly listed on the PNG Stock Exchange (PNGX) and must also comply with the PNGX Listing Rules.

Risk Management Structure

CCP has a conservative yet consistent approach to risk, which has seen us deliver sustained long-term growth by protecting our capital, to lend responsibly and support our business growth.

All of our employees are responsible for the management of risk, with the ultimate accountability residing with the Board. Our risk culture is developing and will be embedded through clear and consistent communication and appropriate training for all employees.

A comprehensive Risk Management Framework that is under continuing development, is applied throughout the Group, and is reinforced with our values and Codes of Conduct.

II. THE BOARD OF DIRECTORS

1. THE BOARD STRUCTURE AND ROLE

The Board of Directors has ultimate responsibility for the success of the Group, is charged with delivering sustainable financial performance and long-term shareholder value, and is responsible for the overall direction, supervision and control of the Group and its management.

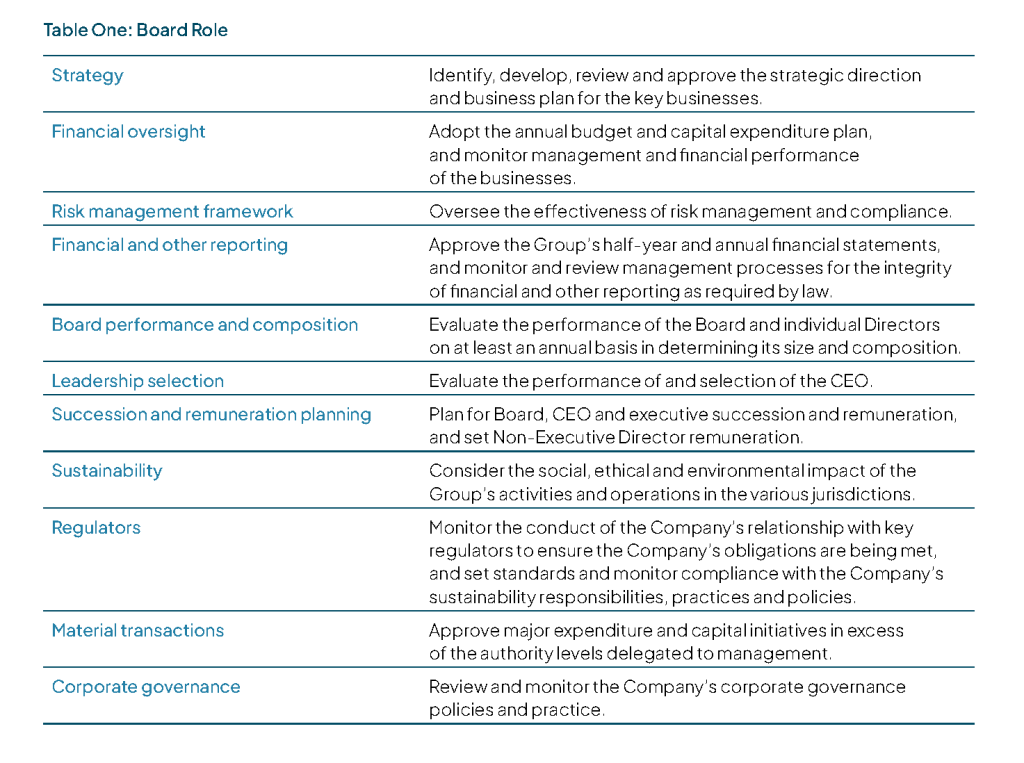

The Board has adopted a Board Charter, that sets out, among other things:

- the role and responsibilities of the Board (the key aspects of which are set out in Table One), including

matters specifically reserved to the Board; and

- the role and responsibilities delegated to the Chief Executive Officer, which is primarily the management of the day-to-day operations of Credit Corporation.

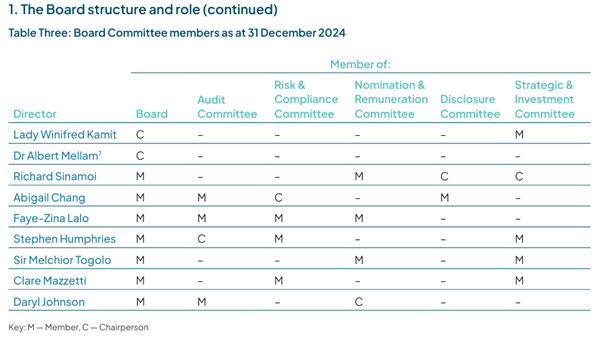

The Board comprises nine Directors (six independent Non-Executive Directors and three Non-Executive Directors).

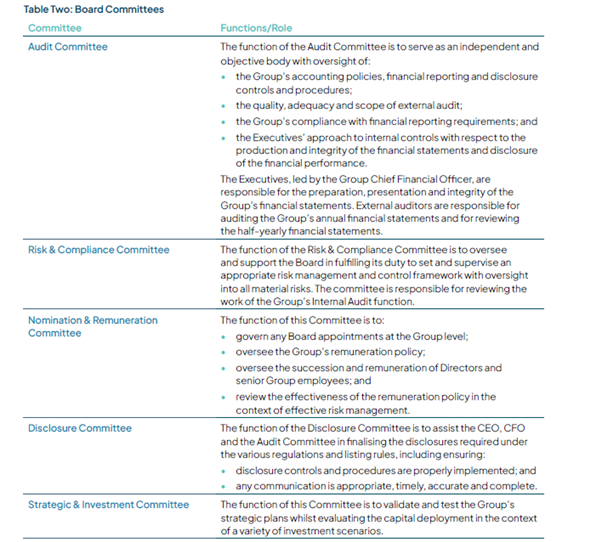

The Board operates within the ambit of the Companies Act 1997, the Credit Corporation’s Constitution and the Board Charter. In discharging its duties, the Board has elected to form 5 (five) separate Board committees.

Each committee is governed by its own Charter which defines roles, responsibilities and membership, and each committee provides recommendations to the Board and advice on specific issues.

2. Board’s relationship with the Chief Executive Director

The Board confirms the duties and responsibilities of the CEO annually, and approves the Key Performance Indicators for the CEO, linked to the Group’s strategic goals as set by the Board.

The CEO is responsible for the day-to-day management and operations of the Group’s businesses and reports to the Board on key operational and management issues, including both financial matters and material risk and compliance matters.

3. Board Chairperson

Lady Winifred Kamit joined the Board of Credit Corporation (PNG) Limited in March 2023 and was appointed as Chairperson in August 2024.

The role of the Board Chairperson is set out in the Board Charter and includes:

• representing the Board to shareholders and communicating the Board’s position

• leading the Board, and facilitating and encouraging constructive discussion in meetings

• assessing and agreeing professional development plans for all the Directors; and

• monitoring the contribution of individual Directors, and providing annual feedback on their performance and effectiveness.

The performance of the Board Chairperson is reviewed every year by the Board as part of the annual Board Self-Assessment Process. The Board understands that Board leadership is key to having an effective Board that sets the direction of Credit Corporation and its subsidiaries, and discharges its fiduciary and other duties under the Companies Act and other laws.

4. Board Skills and composition

The Board seeks members who combine a broad spectrum of experience and expertise with a reputation for integrity and localised knowledge in the jurisdictions we operate.

Directors are chosen from external leaders in the community based upon contributions they can make to the Board and management. Our Board is able to challenge management in a constructive manner and drive strategic results.

The Board comprises a majority of independent Directors and, as a collective group, offers a diversity of skills, opinion and perspectives with varying experiences, gender and demographics. This drives robust decision making.

Regular review of membership is conducted by the Board to ensure the current and future members provide the mix of skills necessary to support the strategic direction and rise to the challenges of the Group.

The key skills and experience of the Board members are captured below:

5. Board performance evaluation

The Board expects a high level of performance from each Director. The Chairman is responsible for the performance evaluation process to confirm this.

The Board assesses its performance each year and is required to have an independent assessment every three years as part of compliance with the BPNG Prudential Standards. The last independent Board assessment was conducted in 2021.

6. Director appointment and election

The appointment of Directors is governed by Credit Corporation’s Constitution. All Directors are appointed for an initial three-year term. Directors can only serve a total of three terms, making a total of nine years.

All Directors must satisfy two requirements prior to taking up active duty on the Board — they:

- must be cleared by BPNG as a ‘Fit and Proper’ person pursuant to the Prudential Standards issued by BPNG under the Banks and Financial Institutions Act 2000; and

- they must be duly appointed by the Board or the shareholders in a general meeting in accordance with the Constitution.

A Director appointed by the Board holds office only until the next AGM and is eligible for election by the shareholders at that meeting.

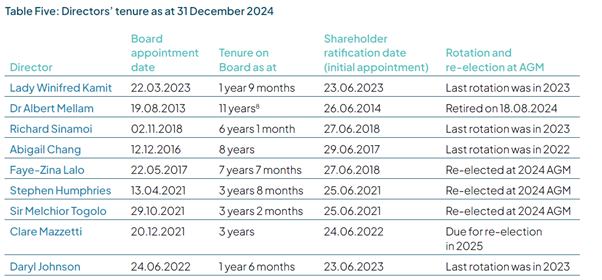

Table Five presents the summary of Directors’ tenure with an indication of rotation of Directors pursuant to Article 66 (2) of the Constitution.

7. Director Development

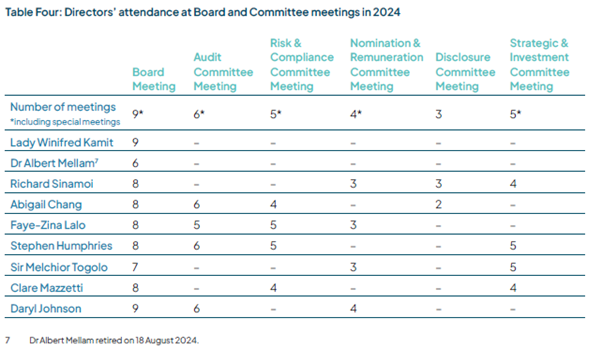

In 2024, there were a number of external workshops and courses that Directors participated in to improve the Board’s performance, oversight capability and insight into the business. All Directors completed the required 20 hours of training in the year.

8. Director Independence

The Board determined that a majority of the Directors (six out of nine) were independent throughout the reporting period. The Board reviews the interests notified by Directors regularly and formally assesses Director independence annually.

Directors are considered to be independent where they are independent of management and free of any business or other relationship that could, or reasonably be perceived to, materially interfere with their capacity to bring independent judgement on issues before the Board and to act in the best interests of Credit Corporation and its shareholders generally. Independent Directors must not be an ex-employee of Credit Corporation, nor should they hold more than a 5% shareholding interest in the company. As part of the formal independence assessment, the Board considers all business relationships between the Group on the one hand, and the Directors and companies of which they are directors or substantial shareholders on the other hand. In each case, those business relationships were of an amount not material to both parties and the Director was not involved in decisions about those relationships

9. CEO and senior executive performance and remuneration

The Nominations & Remuneration Committee reviews the performance of the CEO and executive employees and makes recommendations about remuneration and employment conditions to the Board for approval.

10. Conflicts of interest

Any Director who considers they have a conflict of interest or a material personal interest in a matter concerning Credit Corporation must declare it immediately to the Board Chairperson.

The Company Secretary maintains a Register of Interests which is updated at every Board meeting. The Secretary monitors all information coming to the Board and its committees, and potential conflicts are flagged with the affected Director and the Board Chairperson.

11. Independent advice

Directors are entitled to seek independent advice on their duties at the Group’s expense, provided that they receive the prior approval of the Board Chairperson. The advice is normally made available to all Directors. No Director sought independent advice during the 2022 year.

12. Company Secretary

There is one Company Secretary for the Board and the Board committees. The Company Secretary is appointed by the Board under the Constitution.

The Company Secretary is accountable directly to the Board, through the Board Chairperson, on all matters to do with the proper functioning of the Board.

III. RISK MANAGEMENT & ASSURANCE

1. RISK MANAGEMENT FRAMEWORK

The Board oversees risk management within the Group. The Group’s businesses are exposed to strategic, financial, operational and compliance related risks. These risks are inherent in finance, property and investment businesses.

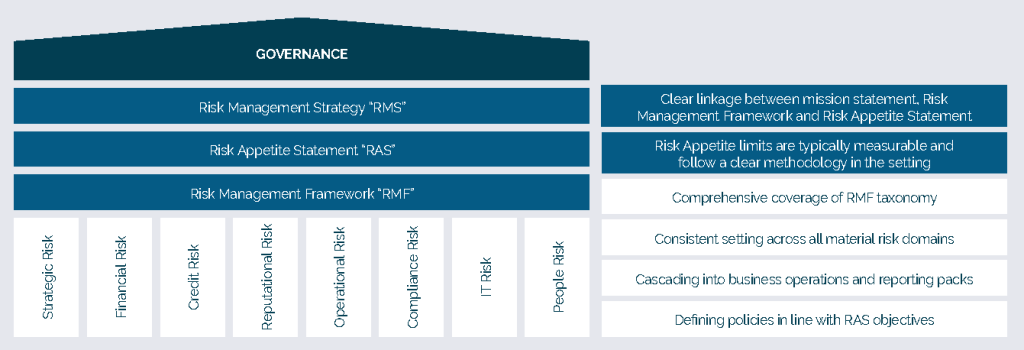

The risk strategy continues to operate a three lines of defence model, but has been enhanced to link risk methodology into its material risk management processes explained in the following diagram.

The Board implemented its annual risk review process resulting in ongoing enhancements in 2021 including the functional shift of key business areas into separate first and second line teams within the Risk Management Framework.

The design of the Group’s Risk Management Framework was reviewed and significantly updated to provide more rigorous risk ownership, accountability and reporting during the reporting period.

The CEO and the Executive Management team ensures risks are monitored, controlled and reported to the Board via the governance framework operated by the Group Risk Office.

The diagram below sets out a description of how risk governance operates in the Group together with key responsibilities of the Board, the Group Executive Management, Business Units and Audit. The governance is enhanced by three Group Management committees.

2. MATERIAL BUSINESS RISKS

Our material risks have been reviewed and continue to be monitored at the Risk Management Committee and the Board Risk Management Committee.

3. EXTERNAL AUDITOR

KPMG has been the Group’s external auditor for over 20 years. The external audit appointment and performance are reviewed annually. The Board re-appointed KPMG as external auditor in 2021. Every five years the lead audit partner responsible is rotated.

Mr Herbert Maguma was the lead audit partner for KPMG for financial year 2022.

Details of the non-audit services provided by the external auditor over the reporting period are included in the Financial Statements. The Audit Committee has not set any nominal “cap” on the level of non-audit services to be performed by the external auditor, as it considers that this may restrict the ability of Credit Corporation to access the best advisers for the particular task.

KPMG has provided the required independence declaration to the Board for FY22. The independence declaration forms part of the Directors’ Report in the Annual Report.

Credit Corporation does not invite any ex-Group audit partners to be appointed as Directors. If such a person was proposed for appointment in a management position, this would require Board approval.

The lead audit partner attends and presents audit findings to the Audit Committee, and is available to meet with members of the Audit Committee as and when required, including holding in camera meetings with the Committee without management’s presence.

The lead audit partner attends the Credit Corporation’s AGM and is available to answer questions from shareholders relevant to the audit.

4. INTERNAL AUDITOR

PricewaterhouseCoopers was appointed to provide Internal Audit support during the year. Group Internal Audit provides independent and objective assurance services to management and the Board in relation to the internal controls, Risk Management Framework and governance of the Group. It does so through:

- performing audits in accordance with an Internal Audit The Plan is formulated using a risk-based approach and approved annually by the Risk Committee;

- having direct access and being accountable to the Board through the Risk Committee, with the right to communicate to it in the absence of management; and

- regular reporting to the Risk Committee on the results of its audits.

The Risk Committee has an Internal Audit Charter and is responsible for reviewing the performance of the Internal Audit Manager and the function each year.

IV. COMMUNICATING WITH SHAREHOLDERS

1. SHAREHOLDER ENGAGEMENT

Shareholders and other stakeholders are informed of all material matters affecting Credit Corporation through PNGX announcements, periodic communications and a range of forums and publications available on Credit Corporation’s website. These communications are part of Credit Corporation’s continuous disclosure obligations. Shareholders have the option to utilise electronic communications.

Other shareholder engagement activities include:

- the Annual General Meeting;

- the Annual Report; and

- regular releases of financial information, including half and full-year financial.

V. CORPORATE ETHICS

1. CORE VALUES

The Group’s core values are:

i. fellowship;

ii. integrity;

iii. growth;

iv. impact; and

v. customer obsessed.

2. CODES OF CONDUCT

Credit Corporation has consistently themed Codes of Conduct throughout the organisation. These Codes set out the standards expected of Directors and employees. The Codes of Conduct emphasize the standards of honesty, integrity and fair dealing by all employees in their interaction with customers, suppliers, the community, competitors and each other in the performance of their duties.

3. OTHER POLICIES

The Board and executive management maintain a range of other policies which define Credit Corporation’s commitment to good corporate governance and responsible business practices.

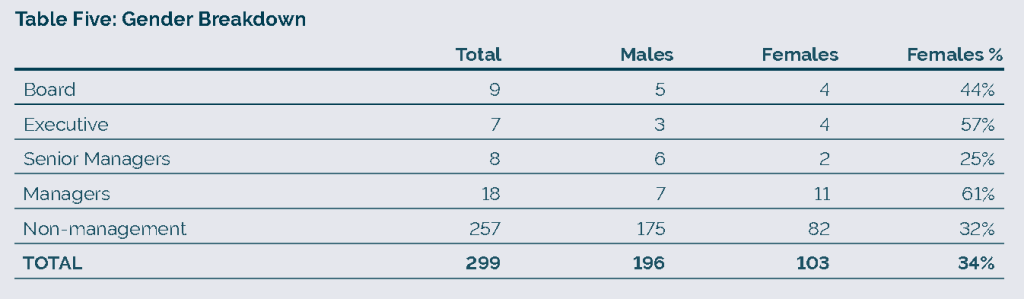

VI. DIVERSITY

Credit Corporation drives diversity throughout the Group in a number of lead areas such as social diversity (race, nationality, age), gender, skills and experience and thought leadership. We celebrate diversity and inclusion, and see them as key strengths. Across our operations spanning five nations — in our boardrooms, meeting rooms, branches and all places in between — this commitment to diversity and inclusion helps ensure that everyone at Credit Corporation feels valued, respected and heard.

We believe teams that are both diverse and inclusive attain higher levels of engagement, loyalty and growth, and through diversity of thought comes innovation and better decision-making. As a company that is founded on strong partnerships and relationships, we know that diversity and inclusion help us better reflect the different needs and perspectives of the communities we serve so we are better able to meet their needs. Our commitment to diversity and inclusion goes beyond the doors of our business.

We support customers and communities through a range of initiatives, such as making financial services more accessible to customers with diverse needs and contributing to branch-level celebrations of cultural expression.

Credit Corporation is proud to promote inclusion in the communities where we operate, and to support the diversity of all our employees and customers.

The Group supports female representation at all levels of management and business operations, and has appointed many talented female Directors and employees. Focused leadership coaching and mentoring will continue as part of our overall succession planning for male and female talent.

VII. CORPORATE SOCIAL RESPONSIBILITY

The Group supports community projects and incentives that relate to women’s and children’s health welfare, local disaster relief outreach programs and youth through sporting sponsorships. This community support is reported at page 28 of the Annual Report.